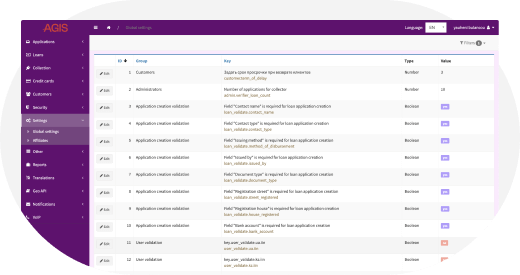

AGIS – modular automated loan management system

AGIS is a adaptible credit conveyor that receives, processes and scores clients applications in order to imburse loans with the minimal human actions and bring your business on a completely new level.

AGIS allows you to quickly and effectively automate integrations with partners, client relationship actions and product management with the use of completely customizable algorithms proven by time.

Our expertise

We are proud that our company is not just a team of software developers – we are experts in the adjustment and automatization of loan processes. We are confident about our capacity to solve your business challenges and exceed your expectations. At the same time, our expertise is your expertise because AGIS experts never hesitate to dive into your business.

FinTech products to manage your business

We offer a comprehensive software ecosystem that allows you to enhance and automate the loan origination and servicing processes with the use of following solutions:

-

Sign-in/Sign-up

-

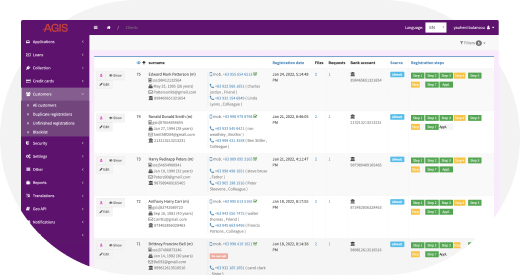

Collection of client details

-

All-in-one personal account

-

Loan documentation and terms

-

Custom frontend functionality

-

Loan application

-

Client verification via KYC/AML and credit data providers

-

Automated scoring

-

Automated decision making

-

Documentation issuing

(e-signature/OTP)

-

Loan transfer

-

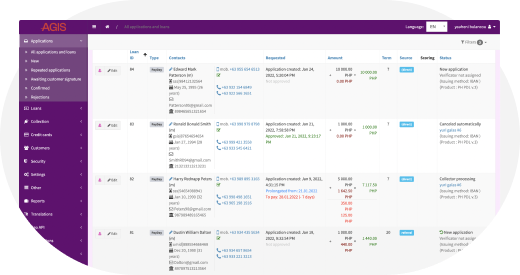

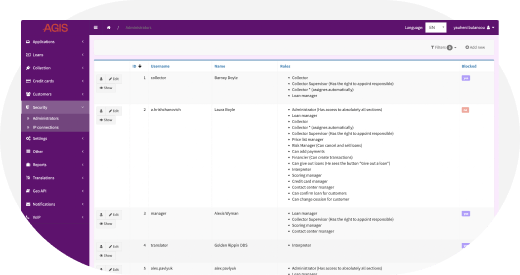

Back office for loan and account management

-

Loan product management

-

Loan documentation management

-

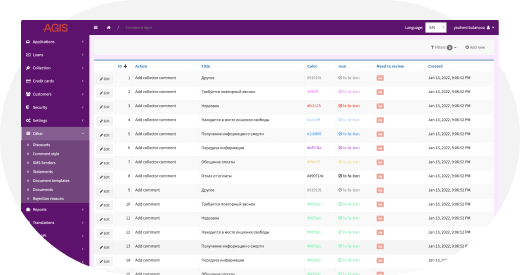

Automated communication algorithms

-

Reports and analytics

-

Segmentation of debtors

-

Real-time debt analytics

-

Debtor account

-

Bucket composal for collection teams

-

Legal penalties

-

Instant payment tracking

Integrations

The AGIS ecosystem supports integration with multiple local and international third-party software solutions and state institutions.